§ 24-261. Use of funds and road benefit zones.

(a)

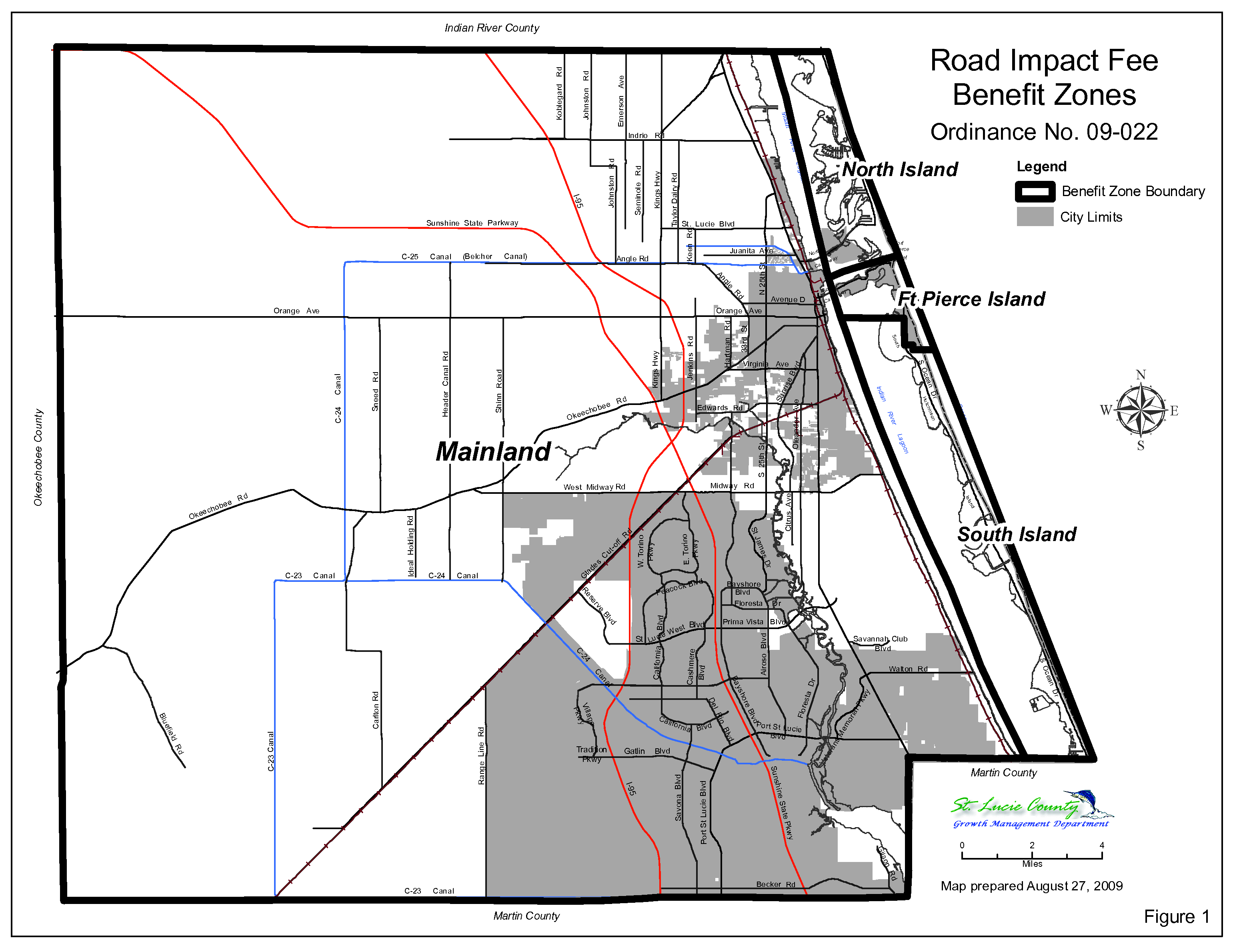

There is hereby created the Mainland Road Benefit Zone, the North Island Road Benefit Zone, the Fort Pierce Island Road Benefit Zone, and the South Island Road Benefit Zone. The boundaries of the various benefit zones are as depicted in revised Figure 1.

(b)

All funds collected from road impact fees shall be used solely for the purpose of capital improvements or enhancements to transportation facilities associated with the arterial and collector road network of the county as identified in the county's comprehensive plan or the comprehensive plans of the City of Fort Pierce, City of Port St. Lucie, St. Lucie Village or by the state and identified within the technical memorandum entitled "Methods Used to Calculate Consumption Driven Road, Public Buildings and Parks and Recreation Impact Fees," dated October 29, 2009, by Dr. James C. Nicholas, which contains the most recent and localized data and which is incorporated by reference. Road impact fees shall not be used for maintenance or operation purposes. Such improvements shall be of the type as are made necessary by the new development.

(c)

Except as provided in subsection (d) of this section, all funds shall be used exclusively for identified road capital improvements within the road benefit zone from which the funds were collected or for projects in adjacent road benefit zones which are of direct benefit to the road benefit zone from which the funds were collected. Funds shall be expended in the order in which they are collected. For purposes of this article, the road benefit zones shall be as depicted in revised Figure 1.

(d)

Each July the county administrator shall present to the board of county commissioners a proposed capital improvement program for roads on the arterial and collector road network of the county, assigning funds, including any accrued interest, from the several special revenue funds to specific road improvement projects and related expenses. Monies, including any accrued interest, not assigned in any fiscal year shall be retained in the same special revenue funds until the next fiscal year except as provided by the refund provisions of this article.

(e)

The collecting governmental entity shall be entitled to retain not more than four percent of all impact fee funds it collects to offset the actual costs of administering and enforcing this article.

(Code 1982, § 1-17-31; Ord. No. 85-10, pt. A, 11-12-1985; Ord. No. 87-2, pt. A, 8-25-1987; Ord. No. 93-002, § 1, 2-16-1993; Ord. No. 95-038, pt. A, 9-19-1995; Ord. No. 98-021, pt. A, 10-20-1998; Ord. No. 00-004, pt. A, 5-9-2000; Ord. No. 05-030, pt. K, 9-6-2005; Ord. No. 05-037, pt. B, 10-11-2005; Ord. No. 09-022, pt. D, 12-15-2009)